When can I retire? Calculating time, savings, and portfolio#

The output should be written here, but perhaps you have JavaScript disabled?

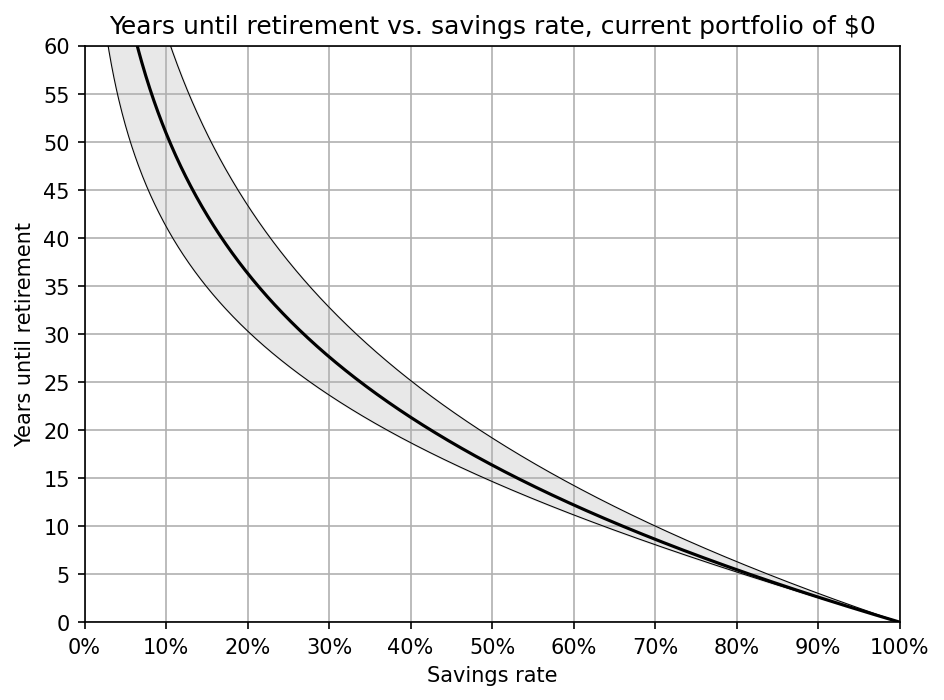

The key thing to notice here is that your savings rate is far more important for an early retirement than your return on investment. Every cut to your expenses has a dual impact – it increases the amount of money you are saving for your future and reduces the amount of money you’ll need in retirement.

Assumptions#

All values above are presented in today’s dollars (i.e., they reflect current purchasing power) and the calculations assume

- Your “current income” is post-tax.

- Your cost of living (income minus savings) remains steady, adjusted for inflation.

- Your “annual savings” are continuously invested.

- The “annual return on investment” is after taxes and inflation.

- Your goal is to retire indefinitely (i.e., your net worth in retirement will never shrink).

See also and references#

- The underlying calculation details in “Deriving Analytic Retirement Estimates: A DIY Approach”.

- My earlier post about “The Importance of Saving Early for Retirement” and the linked resources therein on budgeting, investing, and planning for retirement.

- Networthify’s Early Retirement Calculator, which heavily inspired this page as I wanted to improve on its assumptions and address some slight inaccuracies.

- FIRECalc, a more sophisticated retirement calculator based on historical market simulation and backtesting.