Many Americans underestimate the importance of early retirement savings, often assuming they can delay saving until later in their careers.

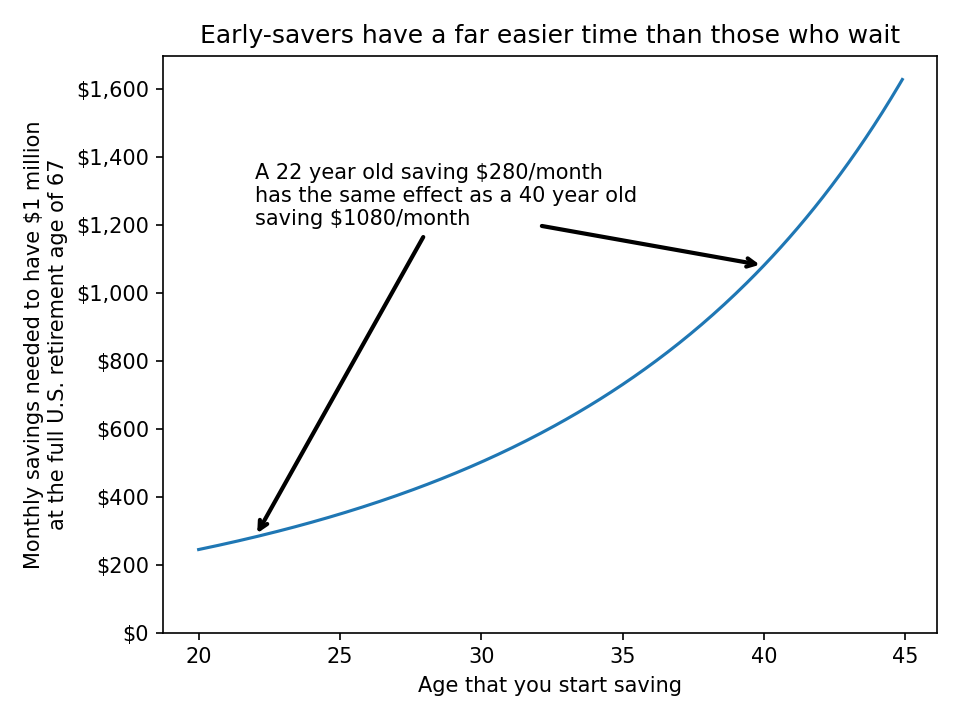

On the contrary, a 22-year-old college graduate that saves $300/month will have more in retirement than a worker who starts saving $1,100/month at 40 years old.

As such, if you are financially stable, it is best and easiest to start saving early!1

In this article, we’ll explore the significance of saving for retirement in your early working years by focusing on the power of compound growth alone. However, you should keep in mind such savings generally decrease your income taxes, are partially matched by your employer, improve your budgeting capabilities, and provide several other benefits. I think we can all agree that financial security and peace of mind in retirement go a long way to relieving stress in our daily lives.

Comparing different retirement saving strategies#

Consider three people who start investing at different times but all retire at 70 years old.

- A high school graduate who consistently saves $375/month from age 18 and continues through their adulthood. This is 15% of a $15/hour paycheck.

- A coworker who starts saving $700/month at age 30.

- Their manager who waits and tries to catch up by saving $1,450/month at age 40.

Perhaps surprisingly, the early-saving high school student comes out on top. They end up with ~$2.2 million in today’s dollars after investing $234k in total.

On the other hand, the coworker and manager both end up with ~$1.7 million after investing $336k and $522k, respectively.

Clearly, #1 is the best option here. The high-school student invested the least amount, has the most money in retirement, and didn’t have to experience huge, sudden losses of disposable income in the middle of their working career. Starting early with small contributions can yield greater savings than starting later with much larger ones!

Now, let’s visualize some of these fundamental benefits of saving early.

Saving early is easier#

As the saying goes, “the best time to start investing was 20 years ago and the second-best time is now.”

If you plot out the amount you need to save each month for a fixed nest egg at retirement, you find that it becomes exponentially harder the more you wait.

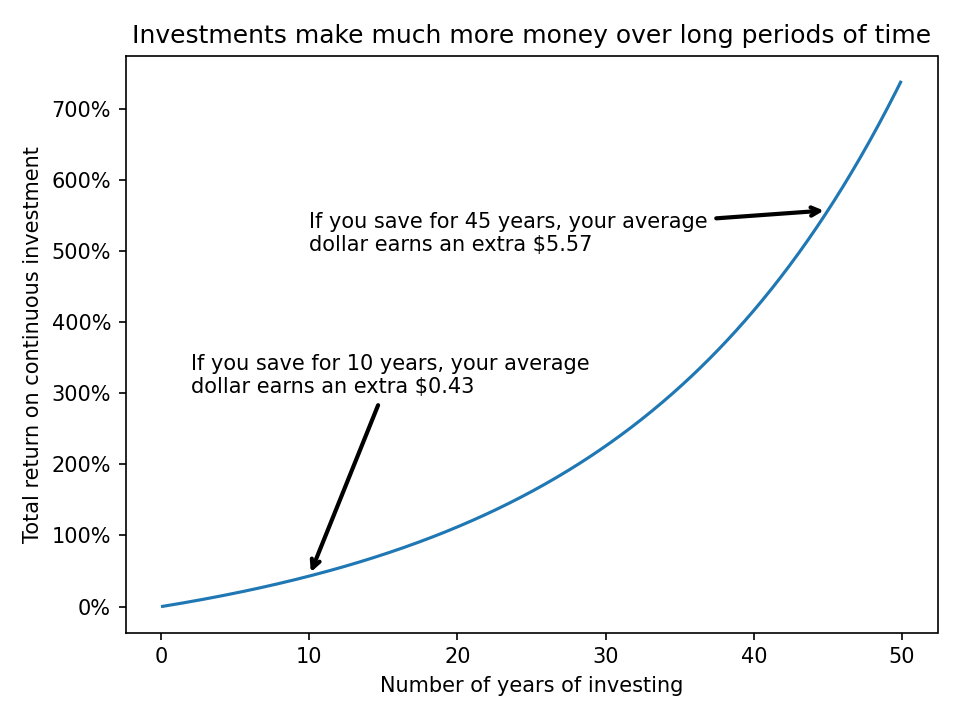

Saving longer makes you exponentially more money#

Investments grow significantly over time, thanks to the power of exponential compound growth. However, the degree to which this effect snowballs may be unintuitive if you have not worked with it before.

Remember, the longer your money stays invested, the more it can grow.

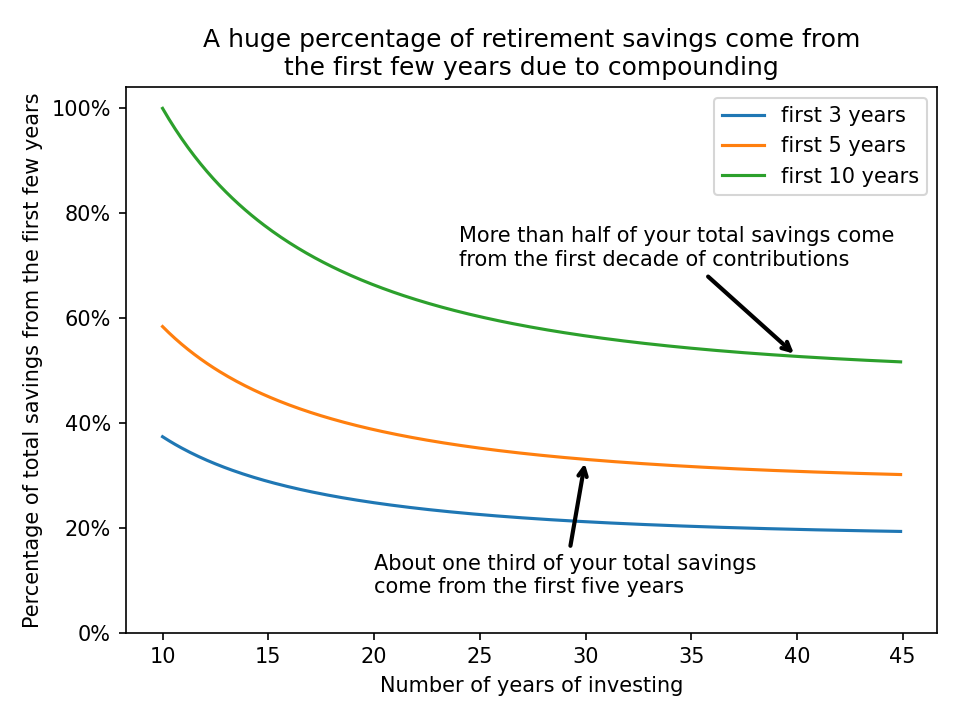

Your first years have the biggest impact#

Compound growth makes the first years of contributions the most influential. They will always have the longest time to multiply, relative to the rest of the portfolio.

The underlying calculations#

To better understand how your choices matter, let’s break down the math behind these savings scenarios. You can freely skip this section if you are not interested.

We assume that these individuals continuously save a set amount each year, and their investments grow at an annualized rate of 7%. This is around the historical average return of the U.S. stock market over the last century after accounting for inflation.

Then, with annual savings of \( s \) dollars, a time horizon of \( T \) years, and an annual growth rate of \( r \), you arrive at a final portfolio value of $$ s \cdot \int_0^T r^t \text{ d}t = s \cdot \frac{r^T - 1}{\ln(r)} $$

If you’re curious about the continuous investment assumption, it is basically equivalent to the more lengthy, discrete calculation of monthly contributions. For example, $$ (\text{\$6000 saved annually}) \cdot \frac{1.07^{\text{(45 years)}} - 1}{\ln(1.07)} \approx \text{\$1,773,827} $$ is quite close to the sum of monthly contributions over the same period, $$ \sum_{t=0}^{\text{(45 years)} \cdot 12 - 1} \left[ (\text{\$500 saved monthly}) \cdot 1.07^{t/12} \right] \approx \text{\$1,768,831} $$

See also and references#

Compound growth favors those who start saving early, so I highly recommend starting as soon as you are able. The following resources are a decent place to start:

- The /r/personalfinance wiki pages on budgeting, building an emergency fund, and saving for retirement or other goals. These provide overall advice and planning options regardless of what your financial picture currently looks like.

- For more in-depth information, see the Bogleheads wiki in general, including their general getting started pages and advice on creating simple three-fund investment portfolios or other lazy portfolios. These are more focused on individuals who are already investing, but do provide some guidance on achieving a sound financial footing for other readers.

Needless to say, I am not a financial advisor and this should not be construed as financial advice. The content provided here is based on general knowledge and research. Please perform your own research and consult with a qualified financial professional as needed before making any significant financial decisions. ↩︎