Vanguard is one of the more predominant advocates of investing internationally, explicitly recommending that investors:

- Hold about 40% of their stock allocation in international stocks, and

- Hold about 30% of their bond allocation in international bonds

They’re also slightly more aggressive than simplistic rules like “invest \( (120 - \text{age})\% \) of your portfolio in stocks.”

Indeed, their target date retirement funds have gradually included more equities and more international exposure over time, so I was curious how well they follow their own recommendations.

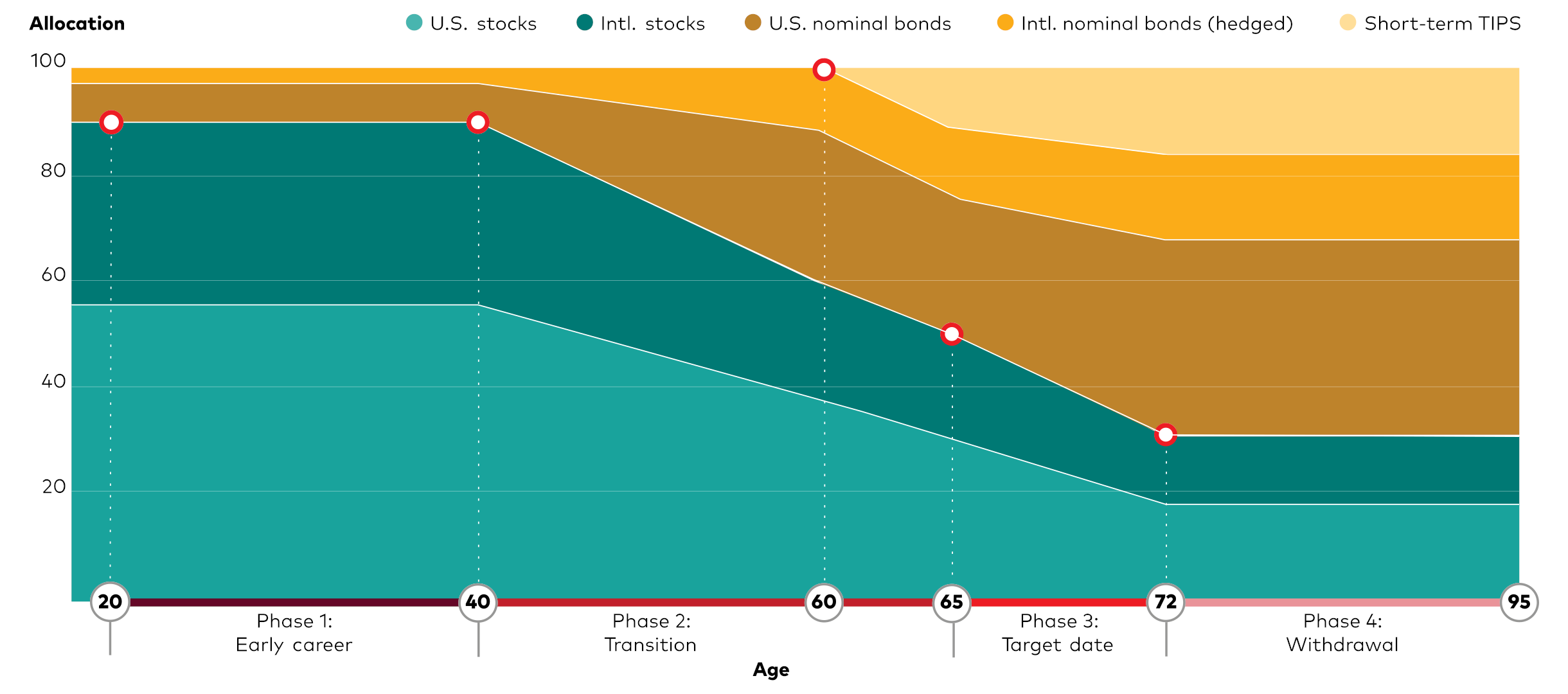

Vanguard’s Target Date Glide Path#

Vanguard’s target date fund documentation shows this glide path for asset allocation across different ages:

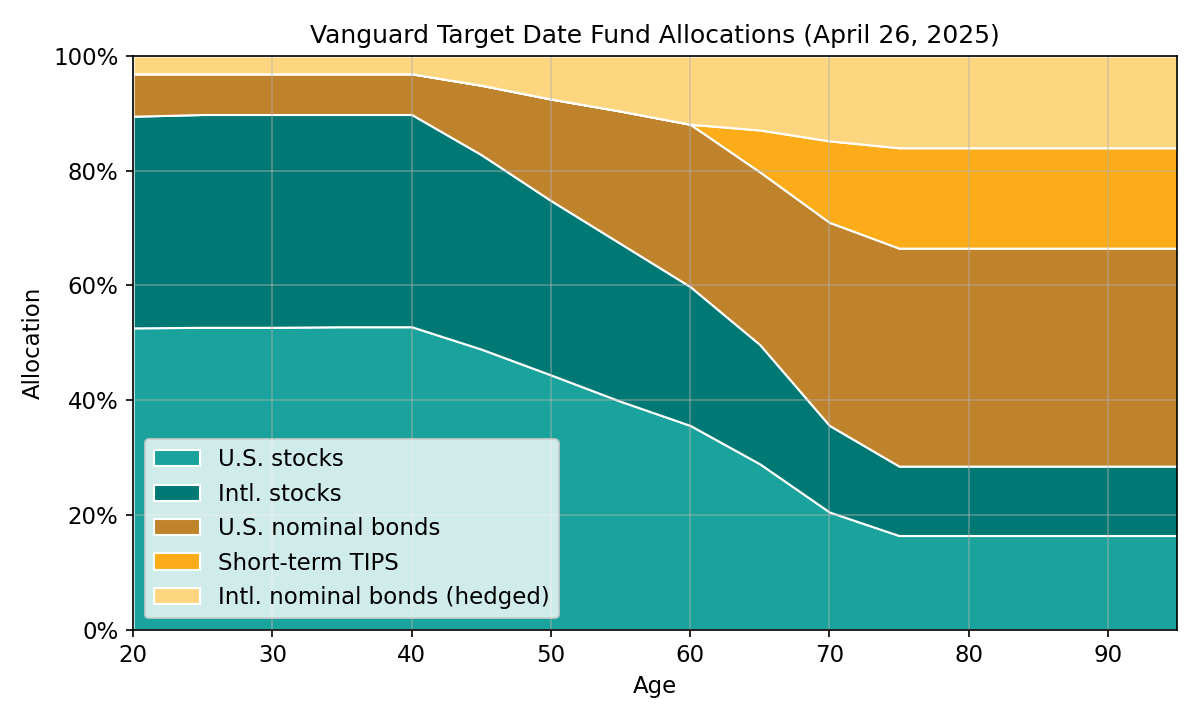

And if we plot out the actual allocations from their various target date funds (roughly targeting investors every 5 years between ages 20-75), they’re pretty close!

Note: I have changed the order of TIPS (Treasury Inflation-Protected Securities) to group them with the other U.S. bonds.

We can extract a few interesting insights from this.

Actual allocation strategy#

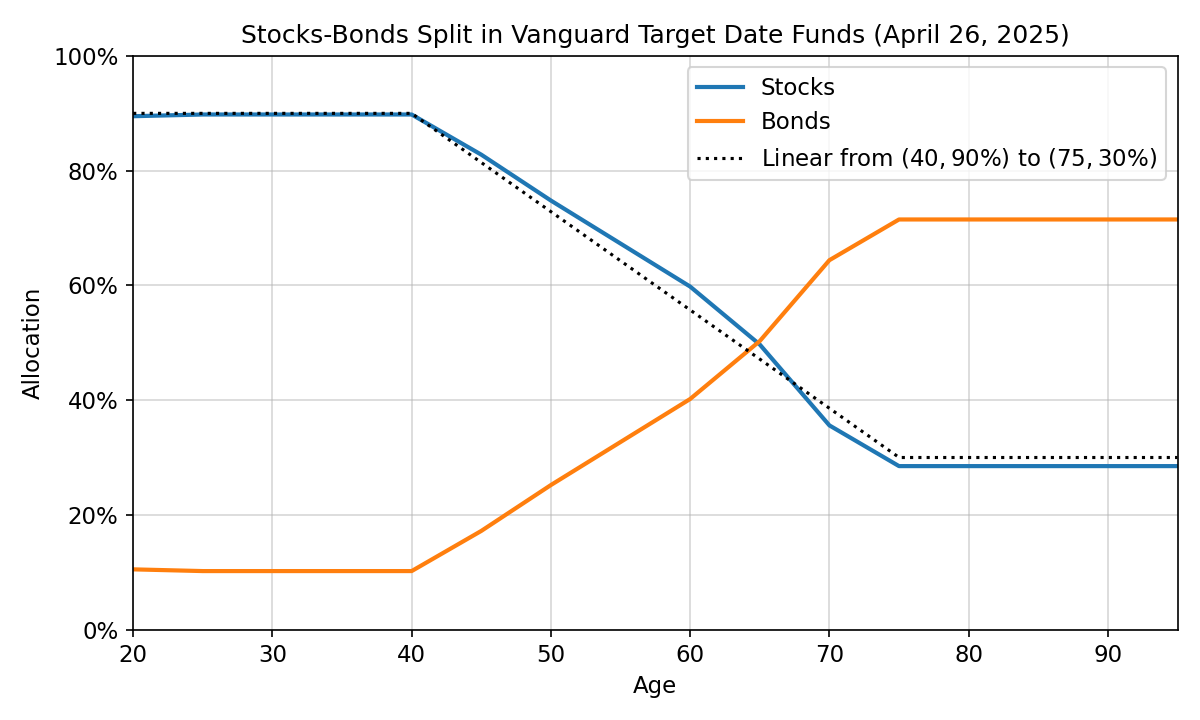

Stocks vs. bonds allocation#

As expected, Vanguard follows their published glide path for the stocks/bonds split.

The portfolios start at 90% stocks until age 40 and then fall to 30% stocks in retirement.

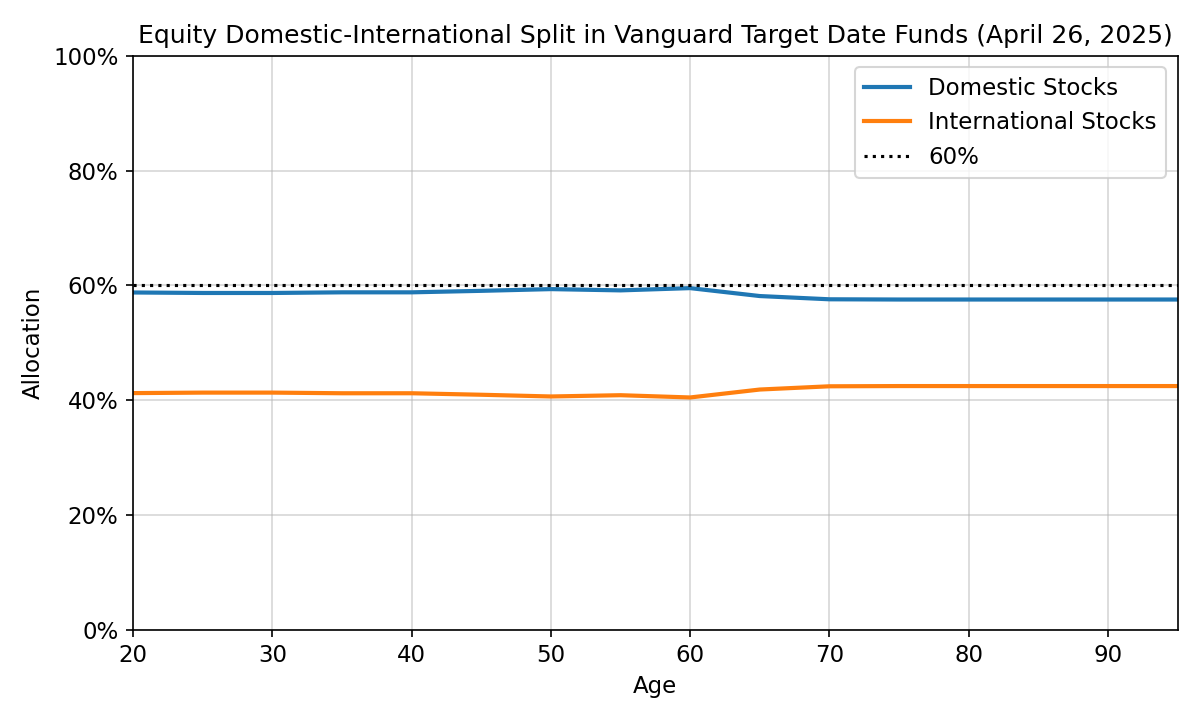

Domestic vs. international equities#

True to their recommendations, Vanguard allocates about 40% of equity exposure to international stocks across all age groups.

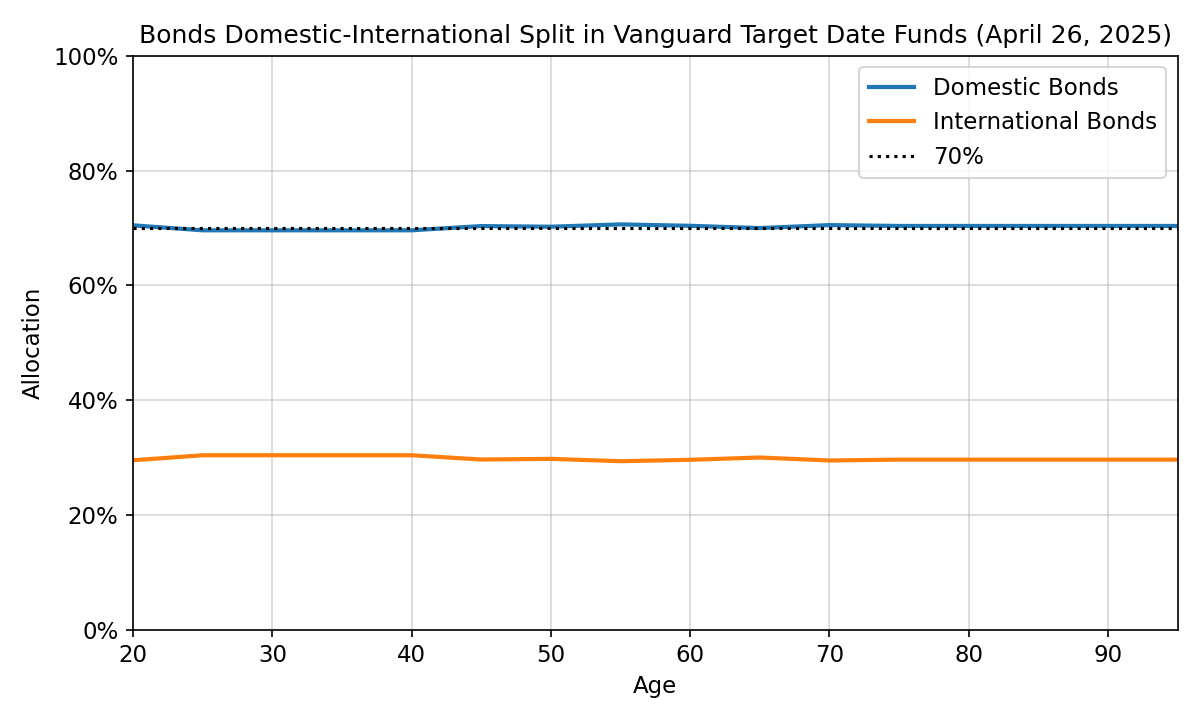

Domestic vs. international bonds#

Similarly, Vanguard uses their 30% international bond allocation recommendation throughout the entire glide path.

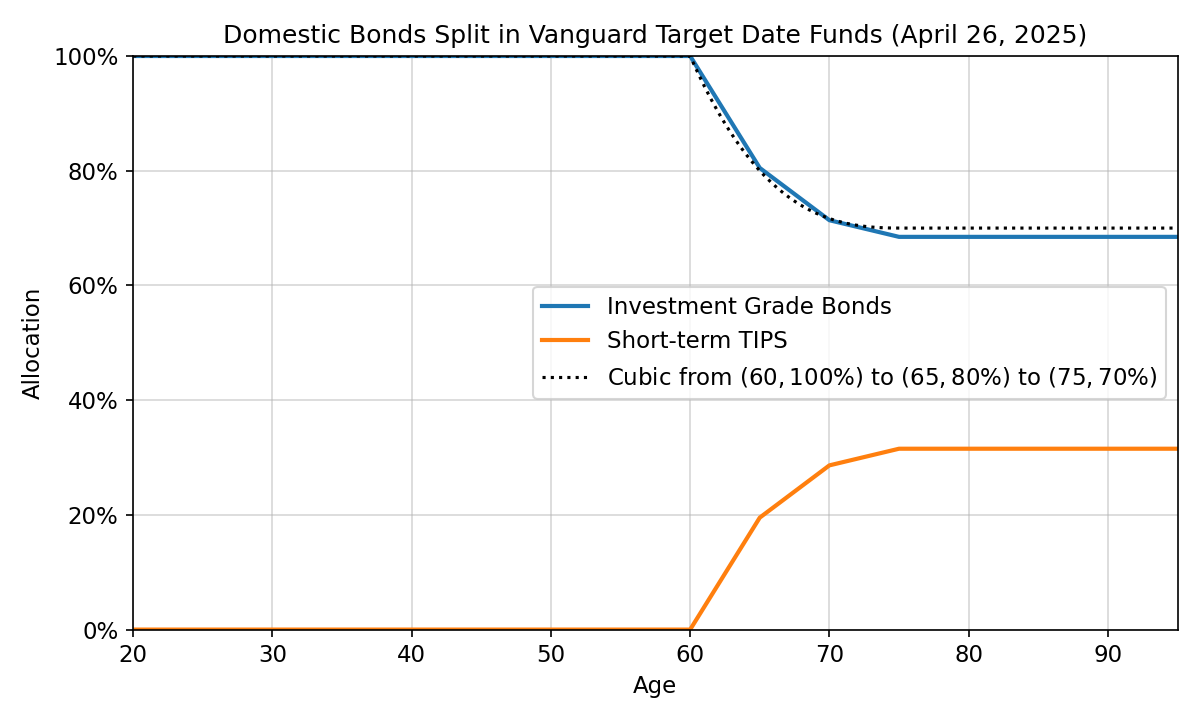

TIPS vs. traditional bonds#

This split is a bit more interesting.

There’s much less public discourse over how much of your portfolio should be in TIPS over conventional investment-grade corporate bonds.

In Vanguard’s case, they rapidly phase them in at age 60.

- They shift 20% of domestic bond allocation to TIPS by age 65,

- Then increase to ~30% TIPS by age 75

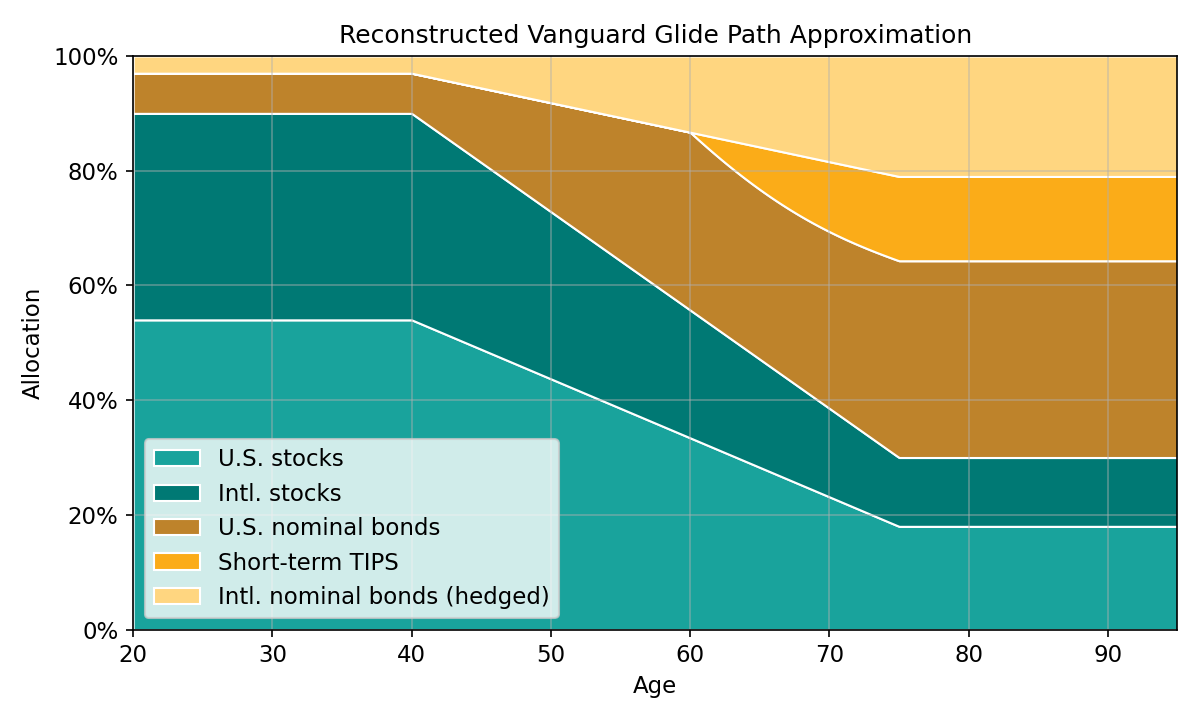

Reconstructing a smoother glide path#

The real data is obviously noisy, especially given the recent market volatility.

Using the patterns observed above, I’ve reconstructed a smoother “Vanguard-style” glide path for every age:

This data is available in reconstructed-glide-path-approximation.csv if you want to take a glance at the exact numbers around your age bracket.

See also and references#

Feel free to look through:

- Vanguard’s official target retirement fund information

- Vanguard’s target glide path in the overview for VTINX. Note that their “actual allocations” on that page are a bit misleading since they exclude certain cash investments, short-term bonds, and futures. Indeed, they do not add to 100%.

- The Bogleheads wiki pages on Asset allocation, Target date funds, Domestic/international splits, and Lazy portfolios

- Information on TIPS bonds from Investopedia, Wikipedia, and Bogleheads